8th September 2022, Changbaishan — Committed to building a cross-border platform facilitating the business development of pharmaceutical players, CHBD (China Health Business Development) successfully held the 17th China Pharmaceutical and Medtech Business Development Forum, partnering with Servier, Xian Janssen, GSK, MSD, and many other leading pharma players.

With the theme of “Double Cycle of Innovation, New Pattern of Value“, the forum brought together elites from various industries in the field of healthcare to explore the opportunities in the pharmaceutical industry from five perspectives: Trends and Opportunities; Capital and Market; AI-driven; New Technology and Vision; Best Practices and Industry Development.

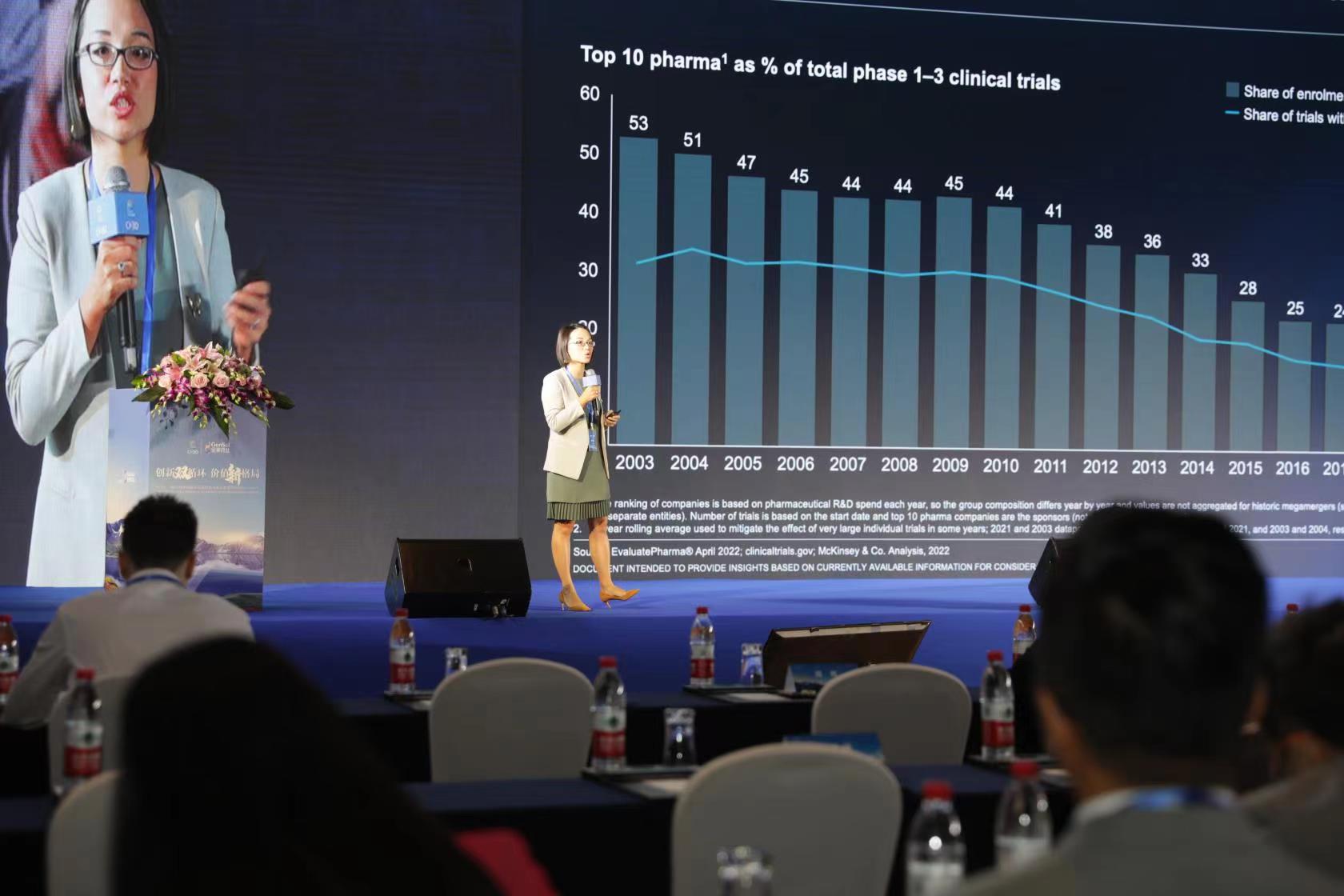

In the first session, ZHOU Xi, Partner at McKinsey, revealed the development trends in China’s pharmaceutical industry, highlighting that China has begun to impact the global biopharma industry. It is shown in a McKinsey report that there were 46 out-licensing deals with US or European biopharma corporations in the past 2.5 years and around 35 clinical-stage oncology assets with global first-wave potential. Although China’s biopharma industry still has ground to cover in research, discovery, and breakthrough innovations, local AI-driven drug discovery (AIDD) companies are emerging as a key part of the value chain and the capital flowing into AIDD is impressive. Among the 20 largest pre-IPO rounds of funding involving AIDD companies in 2021, 7 involved companies are in Greater China1.

Talking about AI-driven, it is also one of the event topics since the call for digital technology integration has been further catalyzed after the pandemic. Jerome Scola, Managing Partner at AYO Innovation, was invited to deliver a keynote speech focusing on new perspectives for pharma digital transformation in China in the post-pandemic age, demonstrating that “China’s digital innovation ecosystem is empowering pharma’s patient care and HCP engagement.”

In the speech, Jerome introduced some cases where harnessing business model innovations can provide patients with wider screening, more precise diagnosis, and better treatment management. Bestcovered, a startup dedicated to Alzheimer’s screening software, has partnered with the Shanghai government and Alipay to realize a screening program, covering a population of over 13 million so far. It only takes 10 minutes for users to complete an Alzheimer’s screening through Bestcovered’s mini-program on Alipay app, making screenings efficient and convenient.

There are also integrated solutions for patients with chronic diseases, complementing traditional drugs with digital solutions to improve precision diagnosis and management. To accompany patients with Parkinson’s disease, Gyenno Science developed a smart spoon that can help patients eat without stress while monitoring and uploading the tremor status to a cloud system. The accumulated real-time data allows HCPs to assess the progress dynamically and adjust the prescription precisely.

From the Gyenno case we can see, thanks to the new experiences brought by online channels and digital tools, it’s now possible for patients to receive personalized treatments remotely. Being accustomed to the proliferation of digital channels and touchpoints, HCPs’ online presence has been drastically rising, varying from online courses and seminars to consultation, follow-up, and public education. According to a DXY report, the main driving forces of HCPs’ online behaviors were expertise upskilling, income raise, and influence expansion. For example, equipped with an intelligent medical image reading system, physicians can shorten the time of diagnosis with higher accuracy. As a digital opinion leader, a physician can impact thousands of people through his knowledge output via online communities.

Simultaneously, HCPs’ online behaviors generate and record substantial data which were not able to track during conventional offline visits. Seeing great business values, major industry players have been building innovative digital solutions to collect and utilize the missing data. By establishing datasets such as HCP profiles, their content interests and product preferences based on information gleaned during digital interactions, the new data would enable the creation of more individualized engagements with HCPs and have a better market understanding. For example, with the help of AI/NLP technology, a 360-degree view of HCP can be formed on top of the database, allowing pharma companies to define the most efficient interaction method and content, transforming engagement experiences for each HCP. This improvement can in turn drive insights into marketing strategies for pharma players as growth engines.

As the theme of the event stated, the Chinese healthcare industry has been creating new patterns of value and contributing to the global healthcare ecosystem by embracing innovation in both biopharma and digital technology.

Reference

- https://www.mckinsey.com/industries/life-sciences/our-insights/vision-2028-how-china-could-impact-the-global-biopharma-industry?cid=soc-web